“First understand it, then measure it and then act”

What’s happening to our planet?

Climate change is putting our planet up against the ropes: Whether hurricanes, blazes, heat waves, floods or droughts, everyday a new climate disaster hits the news. Although there are lots of factors that contribute to it, the IPCC has stated that human influence has warmed the planet at an unprecedented rate and it is mainly caused by Greenhouse Gas emissions to the atmosphere (GHG and refers to CO2-eq or CO2 going forward).

Greenhouse Gases are a type of gases (such as carbon dioxide or methane) that trap Sun’s heat in the atmosphere, causing the greenhouse effect and making Earth a comfortable place to live. However, human activities are changing the natural greenhouse, leading to a warmer Earth (global warming) and causing extreme weather. (Sources: US EPA, NASA and EU)

So, where are those CO2-eq emissions coming from?

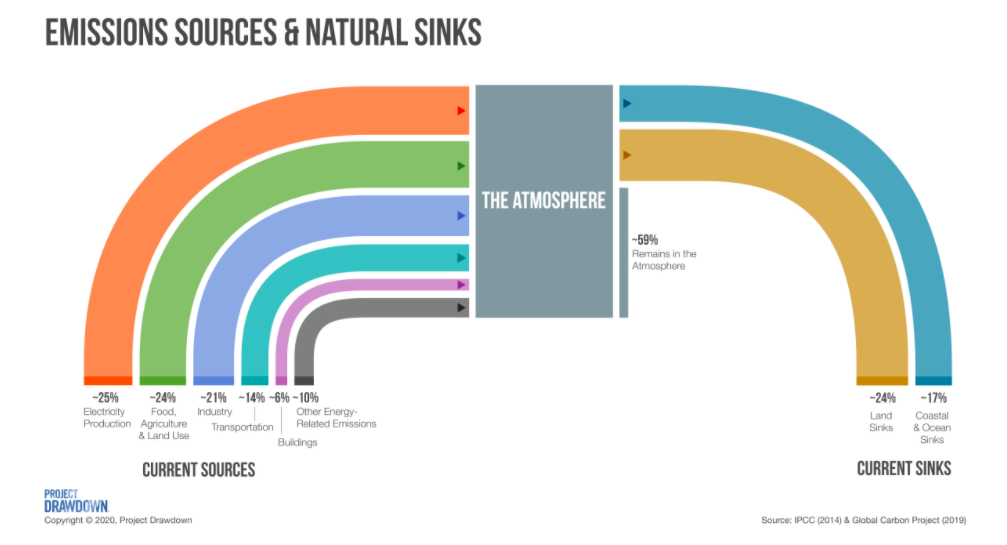

Project Drawdown offers us a useful metaphor: Let’s imagine our atmosphere as a bathtub, of a certain finite size, that is being filled up by two main taps and has two sinks at the bottom. The first tap pours natural CO2-eq (Note: emissions that come from natural sources such as vegetal decomposition, volcanoes, ocean release and animal respiration) and exits through a natural sink (made up by land and oceans) creating a balanced system called the “natural carbon cycle”. On the other side, we have the second tap that pours human-made CO2-eq. Ideally, it should be evacuated through an equal flow sink to preserve the natural carbon cycle. However, that sink relies on new technologies still unavailable at scale and thus the atmosphere is overloaded with GHG which are causing our climate to change.

Since numbers don’t really help to grasp the magnitude of the problem, let’s try to put this into perspective: the human-made tap pours 51 Billion tons of CO2-eq every year which is equivalent to 10 Billion petrol cars driving for 1 year (Hint: The current world population is 7.9 Billion). The vast majority of these emissions come from five sectors as per the following breakdown:

To prevent the bathtub from overflowing, we can either focus on curbing the inflow of man-made GHG in the atmosphere by working to decarbonize each sector or focus on developing new technologies that capture GHG. These are the two main areas of focus for a climate VC.

Our role as impact-VC investor: “And still, we are positive in the way we can achieve it”

As impact-VC investors we seek the double return: financial and impact (which can be either social or environmental), and we do this by focusing on climate, health and education. Within our Climate vertical, we aim to invest in the most disruptive startups with the highest climate return potential: i.e. the next Gigacorn: “A company that has achieved lowering or sequestering CO2 emissions by 1GT/year (1 gigaton = 1 billion tons) while being commercially viable” (Christian Hernandez, Partner at 2150, Twitter).

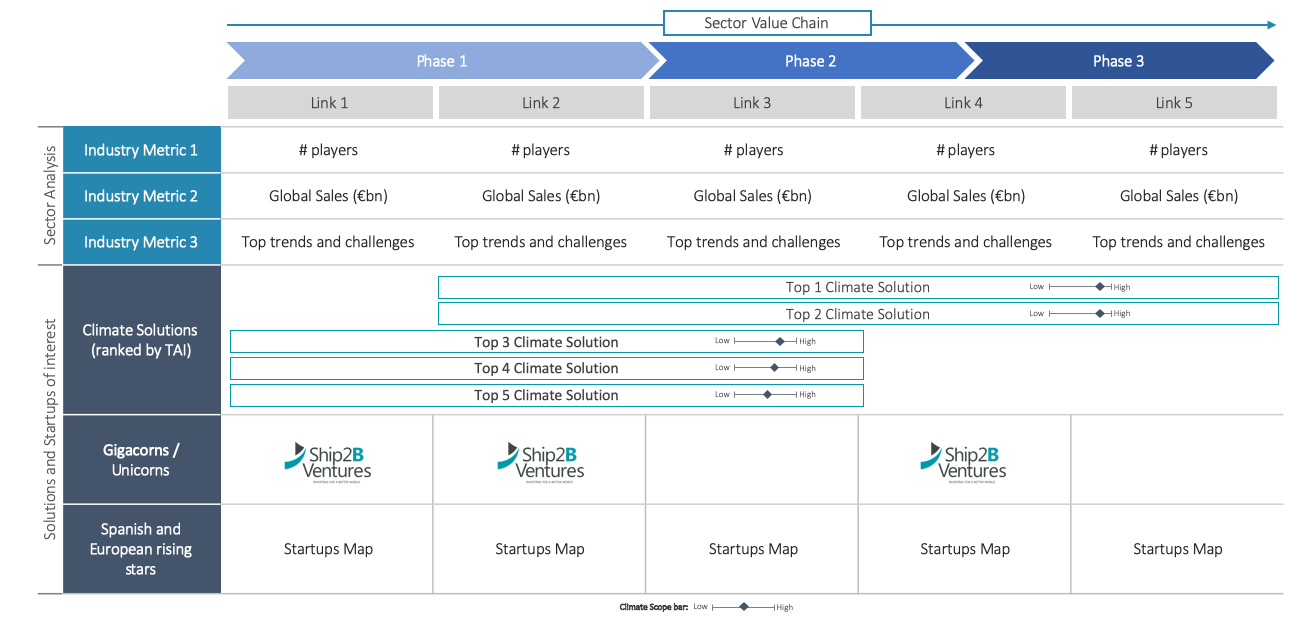

To understand the climate-return potential, we have developed our own methodology based on a bottom-up analysis of each of the five sectors that we cross-reference with a top-down selection of the climate solutions outlined under Project Drawdown:

- Sector bottom-up analysis: we start with a deep dive into each sector’s value chain to understand the big picture and how this is connected to our world and our economies. Looking at the different value chain links, we obtain information on their value-add, interaction, core business activities, number of players, people employed, revenue generation capacity, operating margins, and internal market outlook (key trends and challenges) that enables us to infer their relevance and bargaining power across the chain.

We also look at the main sector trends, challenges and opportunities from a social and environmental perspective (Note: we tend to focus on Europe due to the nature of our investment criteria). - Climate Top-down analysis: In parallel, we select the top climate solutions for each sector ranked by what we coined the Total Addressable Impact (TAI), which means the total amount of CO2-eq that can be reduced or captured over the next decades by that solution. This gives us a sense of two things: i) how each solution may tackle the key challenges of the sector as a whole and ii) where in the value chain could that particular solution generate the most impact.

In future articles, we will share specific case studies of our methodology and how we measure impact overtime.

Our ClimateTech investment model

Once we have formed a clear picture of the value chain and where the main solutions can lie, we go look for entrepreneurs that are pursuing those paths by bringing the most innovative solutions with the highest climate return potential.

This model helps us to position ourselves where impact-driven entrepreneurs and climate opportunities overlap and therefore underpin our investment decisions.

Here is a visual example of our investment model that we apply to each sector:

At Ship2B Ventures, we aim to contribute to reach zero emissions by backing impact-driven entrepreneurs whose projects have the highest CO2-eq reduction potential.

What’s next?

In the following months, we will be sharing the analysis we’ve done for each specific sector. If you are knowledgeable in any of them (Energy, Agrifood, Industrial Manufacturing, Transport & Mobility or Construction) please reach out, we would love to gather your thoughts!

And if you are an investor willing to share impressions or an entrepreneur with a purpose-driven startup in the climate space and are looking for investor partners, please get in touch with us!

JAIME DE ANTONIO

INVESTMENT

ASSOCIATE

Mining Engineer with a Master in Management from HEC Paris. Over 3 years of experience across investment banking and private equity. Currently, he works as Impact Investment Associate at Ship2B Ventures.